WHY INVEST

MT Todd Gold Project

- Demonstrated economic feasibility

- Achievable near-term production

- Premier asset in Tier 1 mining jurisdiction

Enviromental, Social and Governance

- Transparency and accountability

- Sustainable and socially responsible development

- Best corporate governance practices

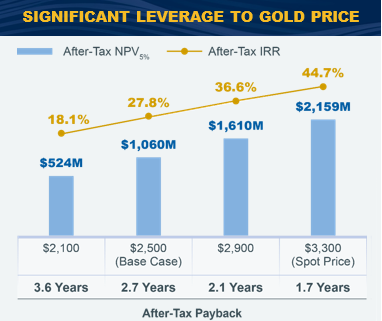

Strong Economics and Rising Gold

Price Environment

Note: 2025 Mt Todd feasibility study.

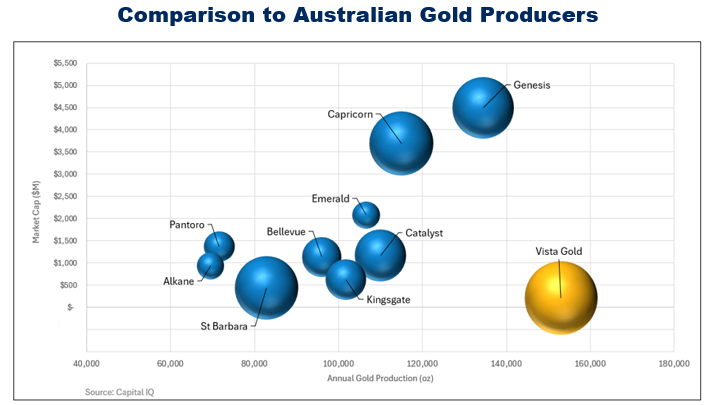

Value Proposition

- Potential Strategic Paths

- Corporate or asset transaction

- Joint venture

- Advance on a standalone basis

- Other form of strategic transaction

- Pursuing Development Options to Achieve Producer Re-Rating

Note: 2025 Mt Todd feasibility study.